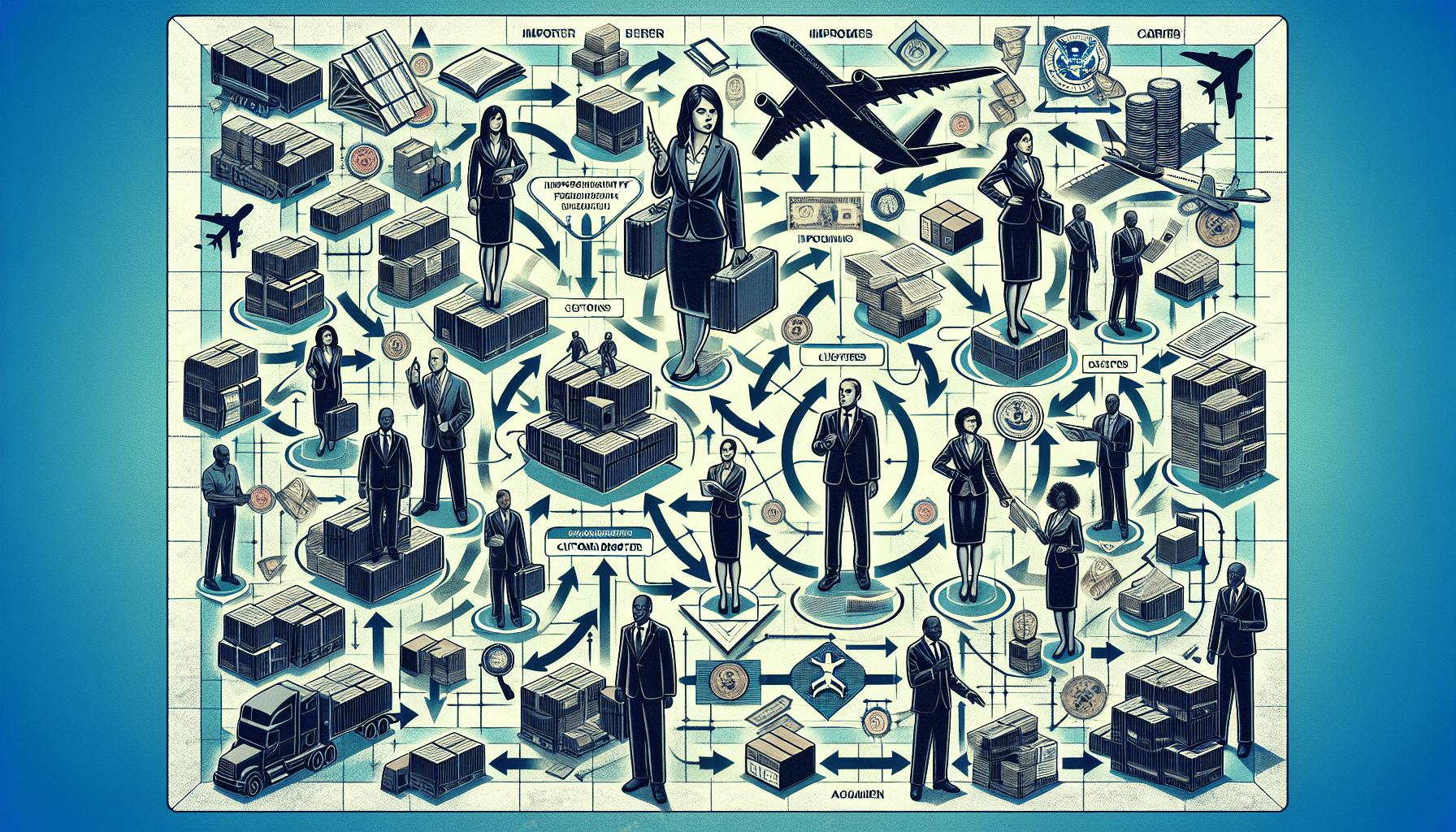

Who Is Responsible For Filing An ISF?

So, you’re wondering who exactly is responsible for filing an ISF, huh? Well, let me break it down for you. When it comes to importing goods into the United States, an ISF, short for Importer Security Filing, is a crucial document that needs to be submitted before the cargo even arrives. Now, the responsibility for filing this ISF falls on the shoulders of the importer or their authorized agent. Yep, it’s on them to make sure all the necessary information is provided accurately and in a timely manner. Trust me, you don’t want to mess up this step, as it could result in delays, penalties, or even the denial of entry for your goods. So, let’s get into the nitty-gritty details and understand exactly who carries the weight of filing an ISF.

The Importer of Record (IOR)

Definition of IOR

The Importer of Record (IOR) refers to the party responsible for ensuring that all necessary documentation and requirements are met for the importation of goods into a country. In the context of the United States, the IOR is typically the entity or individual who owns the goods at the time of entry into the country. It is important to note that the IOR may not always be the actual owner of the goods, but rather the party legally responsible for compliance with customs laws and regulations.

Responsibilities of the IOR

As the Importer of Record, you have several key responsibilities. Firstly, you are responsible for providing accurate and complete information to the customs authorities, including details about the goods being imported, their value, origin, and any applicable duty or tax obligations. This information is crucial for customs authorities to assess the admissibility of the goods and determine the appropriate duties and taxes.

Furthermore, as the IOR, you are responsible for ensuring that all required documentation is submitted to customs in a timely manner. This may include commercial invoices, packing lists, bills of lading, and any other relevant documents. Failure to provide the necessary documentation can lead to delays in the clearance process and may result in penalties or fines.

Additionally, the IOR is responsible for complying with all customs laws and regulations, including any restrictions or prohibitions on certain goods. It is important to stay updated on changes in customs requirements and to seek guidance from experts or customs professionals when needed.

The Customs Broker

Role of the Customs Broker

A Customs Broker is a licensed professional who acts as an intermediary between you, the Importer of Record, and the customs authorities. Their primary role is to ensure compliance with customs regulations and facilitate the smooth and efficient clearance of goods through customs.

Customs Brokers possess extensive knowledge of customs laws, regulations, and procedures, which allows them to navigate complex trade requirements on your behalf. They serve as trusted advisors who can provide guidance on documentation requirements, tariff classifications, valuation methods, and duty and tax calculations.

Responsibilities of the Customs Broker

Your Customs Broker has several responsibilities when it comes to the importation process. They are responsible for preparing and submitting all necessary documentation to customs authorities, accurately representing the goods being imported, their value, and any applicable duties or taxes. They also play a crucial role in ensuring that the customs entry is compliant with all relevant regulations and requirements.

Furthermore, the Customs Broker is responsible for coordinating with various stakeholders involved in the importation process, such as freight forwarders, shipping lines, and other parties. They may liaise with these entities to obtain necessary information, resolve any issues or discrepancies, and ensure a seamless flow of information and documentation.

It is important to note that while the Customs Broker assists with the importation process, the ultimate responsibility for compliance still lies with you, the Importer of Record. However, leveraging the expertise of a Customs Broker can significantly reduce the risk of errors, delays, and non-compliance.

The Freight Forwarder

Role of the Freight Forwarder

A Freight Forwarder is a logistics professional who specializes in coordinating the transportation of goods from the point of origin to the final destination. Their role is to act as an intermediary between various parties involved in the shipping process, including the Importer of Record, customs authorities, shipping lines, and carriers.

Freight Forwarders manage the logistics and documentation required for the movement of goods, ensuring that they are efficiently transported from the supplier to the buyer. They handle tasks such as booking cargo space, arranging for transportation, and preparing the necessary shipping documents.

Responsibilities of the Freight Forwarder

As the Importer of Record, you can rely on the Freight Forwarder to carry out several important responsibilities. Firstly, they are responsible for coordinating the transportation of goods in compliance with customs and trade regulations. This includes ensuring that the proper documentation, such as bills of lading and commercial invoices, is prepared and submitted to relevant parties.

Furthermore, Freight Forwarders are responsible for arranging the physical movement of goods, including booking transportation services, coordinating with shipping lines or carriers, and managing any necessary logistics, such as cargo handling or warehousing. They play a vital role in ensuring that goods reach their destination in a timely and efficient manner.

It is important to maintain open communication with your Freight Forwarder to provide them with accurate and complete information about the goods being shipped, including their value, weight, and any applicable customs requirements. This will enable the Freight Forwarder to fulfill their responsibilities effectively and help prevent any potential delays or issues during the shipping process.

The Shipping Line/Carrier

Role of the Shipping Line/Carrier

The Shipping Line or Carrier refers to the company responsible for transporting goods from the port of origin to the port of destination. They operate vessels or aircraft that carry cargo and offer various services related to the transportation of goods.

Shipping lines or carriers play a crucial role in the international trade process by providing a reliable and efficient means of transporting goods across different regions and countries. They ensure that goods are handled, loaded, and transported in a safe and secure manner.

Responsibilities of the Shipping Line/Carrier

The primary responsibility of the Shipping Line or Carrier is to transport goods from the port of origin to the port of destination according to the agreed-upon terms and conditions. This includes ensuring that goods are properly stored, loaded, and secured during transit to prevent damage or loss.

Shipping lines or carriers are also responsible for providing accurate and complete documentation related to the transportation of goods. This may include bills of lading, cargo manifests, and other essential documents needed for customs clearance and the release of goods at the destination port.

In addition to these responsibilities, shipping lines or carriers may also be involved in certain ancillary services, such as providing containerization options, offering tracking and tracing capabilities, and facilitating customs processes at ports of entry.

The ISF Filer

Definition of ISF Filer

The ISF Filer, or Importer Security Filing (ISF) Agent, is responsible for submitting the ISF to U.S. Customs and Border Protection (CBP) on behalf of the Importer of Record. The ISF is a mandatory filing that must be submitted at least 24 hours before the cargo is loaded onto a vessel destined for the United States.

Responsibilities of the ISF Filer

The ISF Filer has the crucial responsibility of accurately completing and submitting the ISF to CBP in a timely manner. The ISF includes detailed information about the imported goods, the vessel carrying the goods, as well as information about the shipper, consignee, and other parties involved in the shipment.

This information is essential for CBP to assess the security risk associated with the cargo before it arrives in the United States. Failure to submit the ISF or providing inaccurate or incomplete information can result in penalties, delays in cargo release, and potential disruptions to your supply chain.

As the Importer of Record, it is essential to collaborate closely with the ISF Filer, providing them with accurate and complete information about the imported goods, their value, and any other relevant details. Transparency and effective communication between the Importer of Record and the ISF Filer are vital to ensure the timely and accurate submission of the ISF.

The Importer’s Agent or Representative

Role of the Importer’s Agent/Representative

The Importer’s Agent or Representative refers to an entity or individual that is authorized to act on behalf of the Importer of Record in matters related to the importation process. They may be engaged by the Importer of Record to handle specific tasks or to represent them more broadly in import-related matters.

The Importer’s Agent or Representative serves as a liaison between the importer and various parties involved in the importation process, including customs authorities, Customs Brokers, freight forwarders, and other stakeholders. They assist in coordinating and facilitating the importation process on behalf of the Importer of Record.

Responsibilities of the Importer’s Agent/Representative

The Importer’s Agent or Representative has a range of responsibilities, depending on the specific arrangement with the Importer of Record. They may be responsible for tasks such as communicating with relevant parties, coordinating documentation requirements, and addressing any concerns or issues that may arise during the importation process.

Some Importer’s Agents or Representatives may also be authorized to sign customs-related documents on behalf of the Importer of Record. This may include power of attorney arrangements, allowing the Agent or Representative to act with legal authority on behalf of the Importer of Record.

Ultimately, the Importer of Record retains the primary responsibility for compliance with customs regulations, but by engaging an Importer’s Agent or Representative, you can delegate certain tasks and rely on their expertise to ensure a smooth importation process.

ISF Cargo for more Information

The ISF Compliance Provider

Definition of ISF Compliance Provider

An ISF Compliance Provider is a specialized service provider who assists importers and other stakeholders in meeting the requirements of the Importer Security Filing (ISF). They possess comprehensive knowledge of the ISF regulations, requirements, and best practices, enabling them to offer support and guidance to parties involved in the importation process.

Responsibilities of the ISF Compliance Provider

The responsibilities of an ISF Compliance Provider revolve around ensuring that importers and their partners fulfill the requirements of the ISF. They provide assistance and expertise in completing the ISF accurately and submitting it in a timely manner to CBP.

ISF Compliance Providers may offer services such as ISF data validation, ensuring that the information submitted is correct and complies with CBP regulations. They may also provide training and education to importers and their partners to enhance their understanding of ISF requirements and to promote compliance.

By engaging an ISF Compliance Provider, you can benefit from their expertise and knowledge, reducing the risk of errors or omissions in the ISF filing and ensuring compliance with CBP regulations.

The U.S. Customs and Border Protection (CBP)

Role of CBP

The U.S. Customs and Border Protection (CBP) is an agency under the Department of Homeland Security responsible for enforcing customs and trade regulations in the United States. CBP plays a crucial role in facilitating legitimate trade and securing the border by ensuring compliance with various laws and regulations.

CBP is responsible for assessing and collecting duties and taxes on imported goods, as well as enforcing trade policies, such as tariff classifications, valuation methods, and country of origin determinations. They also play a vital role in protecting national security by screening cargo and passengers for potential threats.

Responsibilities of CBP

As the primary customs authority in the United States, CBP has numerous responsibilities when it comes to the importation process. They are responsible for inspecting and examining imported goods to ensure compliance with customs laws and regulations.

CBP conducts risk assessments on cargo and uses various tools and technologies to identify and mitigate potential risks. They also play a crucial role in enforcing intellectual property rights by intercepting counterfeit goods and conducting investigations into trade fraud or smuggling.

Furthermore, CBP administers various trade programs and initiatives aimed at facilitating legitimate trade and enhancing supply chain security. This includes programs like the Customs-Trade Partnership Against Terrorism (C-TPAT) and the Automated Commercial Environment (ACE), which streamline and automate customs processes.

Joint Liability

Shared Responsibilities

In the importing process, it is important to note that multiple parties share certain responsibilities regarding compliance with customs regulations. While the Importer of Record bears the ultimate responsibility for compliance, other stakeholders, such as the Customs Broker, Freight Forwarder, and ISF Filer, also play significant roles in ensuring compliance.

Collaboration and effective communication between these parties are essential to minimize the risk of errors, delays, or penalties. Sharing information accurately and in a timely manner is crucial to enable each party to fulfill their respective responsibilities.

Potential Penalties for Non-compliance

Failure to comply with customs regulations can result in various penalties and consequences. These penalties can range from monetary fines to delays in cargo release, seizure of goods, or even criminal charges in severe cases.

Importers should be aware of the potential penalties and take necessary measures to ensure compliance with customs regulations. Leveraging the expertise of customs professionals, such as Customs Brokers or ISF Compliance Providers, can help mitigate the risk of non-compliance and avoid potential penalties.

Conclusion

Summary of Responsibilities

In conclusion, the importation process involves multiple stakeholders, each with their own roles and responsibilities. As the Importer of Record, you are responsible for providing accurate information to customs authorities, ensuring compliance with customs laws and regulations, and submitting all necessary documentation in a timely manner.

The Customs Broker assists in navigating customs regulations, preparing and submitting documentation, and ensuring compliance throughout the importation process. The Freight Forwarder handles logistics and transportation, coordinating with various parties involved in shipping.

The Shipping Line/Carrier transports goods from the port of origin to the destination port, adhering to shipping regulations and providing necessary documentation. The ISF Filer submits the Importer Security Filing to CBP, ensuring accurate and timely reporting of cargo information.

The Importer’s Agent or Representative acts on behalf of the Importer of Record, supporting and coordinating import-related matters. The ISF Compliance Provider offers expertise and guidance in meeting the requirements of the ISF.

CBP plays a critical role in enforcing customs and trade regulations, promoting national security, and facilitating legitimate trade. It is crucial for all parties involved in the importation process to collaborate effectively and share information accurately to ensure compliance and avoid penalties.

Importance of Collaboration

The importance of collaboration among all parties involved in the importation process cannot be overstated. By working together, these stakeholders can ensure that all necessary documentation is accurate, complete, and submitted in a timely manner.

Collaboration also allows for efficient communication, enabling parties to address any issues or concerns promptly and minimize the risk of non-compliance. Additionally, sharing information among stakeholders can help streamline the importation process, reducing potential delays and ensuring a smooth flow of goods.

Ultimately, collaboration is key to achieving compliance with customs regulations and facilitating a successful importation process. By leveraging the expertise and resources of each party involved, you can navigate the complexities of international trade more effectively and ensure the seamless movement of goods across borders.

Learn more about ISF 10+2 data elements explained. Know more for CBP bond compliance. Feel free to ISF help desk. Return to ISF Cargo logistics compliance center.